Why inflation will soon be over

If you feel we’ve entered into a new inflationary era, you are an economic conservative. You may believe in secular inflation thanks to the following: Brexit, trade wars, de-globalisation, Covid and Ukraine, which have all created shortages in manufacturing, oil, and wheat that we are powerless to fix. Perhaps you believe that sinister world leaders, business interests, and cartels control the markets in all this stuff and have decided to restrict it. Or you may think that central banks have been printing money so recklessly, and for so long, that finally there is too much money versus stuff.

If you feel the current inflation is just a blip, you’re an economic progressive. You may believe inflation is temporary because of the following: innovation is a constant of human progress, a benign deflationary force that continually reduces the cost of living for everybody. You may think that globalisation has stumbled but is fundamentally alive and well, providing ample supply of anything we need, and any attempt to sanction, tariff or control goods results in more production elsewhere or substitute technology. And although protectionist economies may print excessive money to bail out vested interests, the United States’s Federal Reserve has not resorted to outright currency debasement and is even now withdrawing the amount of dollars it (sensibly) printed in the Covid crash.

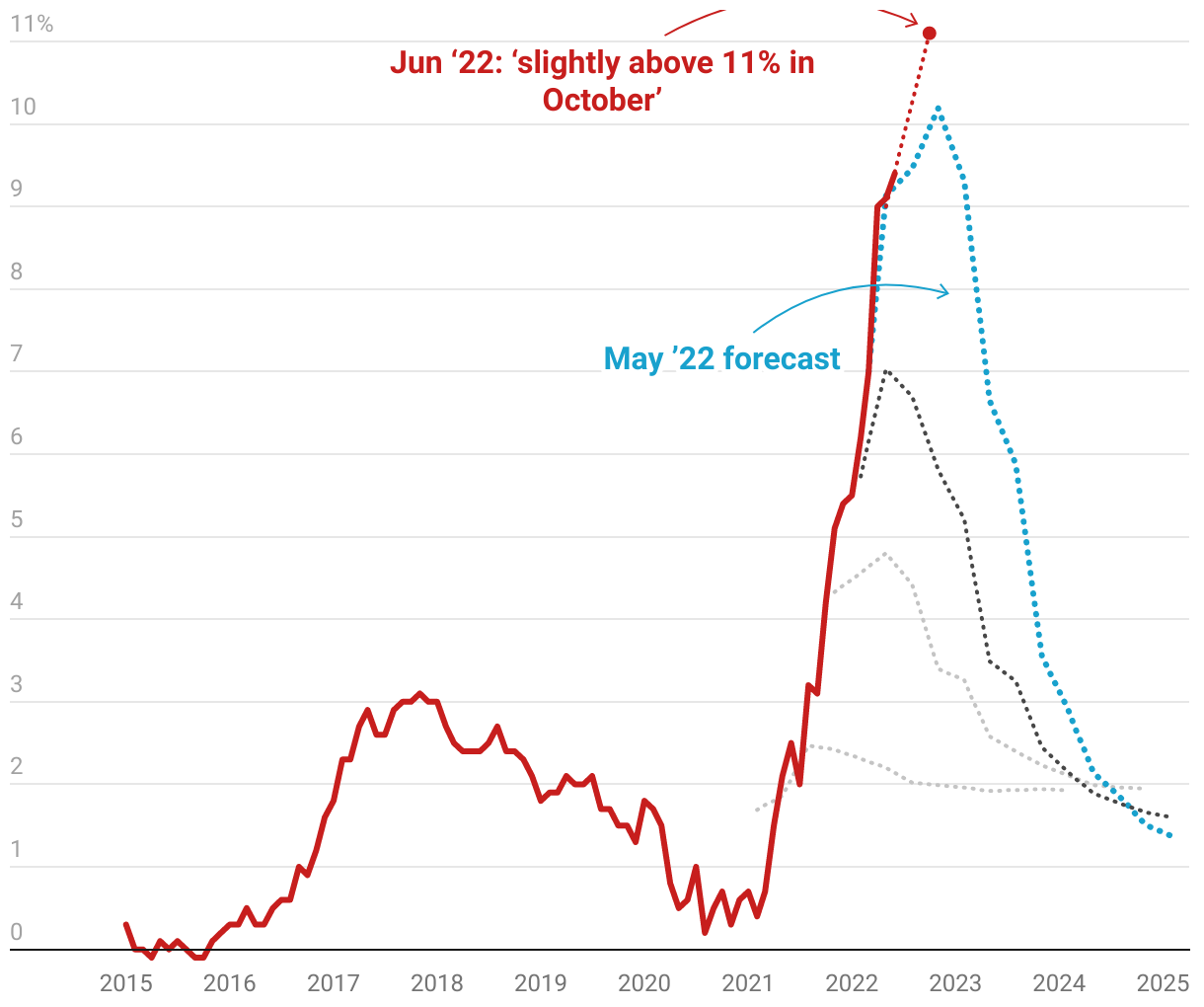

UK inflation jumps to 9.4%, forecast to rise to 11%

Year-on-year change in the consumer prices index (CPI) and forecasts.

BoE OBR

(Please use a modern browser to see the interactive version of this visualizat

Actual figures to June 2022, published 20 July. Next release: 17 August. Latest BoE forecast published 5 May

Emotionally, deflationists believe that the future provides answers to our current problems (even as these answers create further problems to solve). It believes economic history has a rising, progressive line.

I used to be an economic conservative. Two years too early, I predicted the current inflationary period, believing that it would be a new inflationary era.

Being too early is the same as being wrong but I suspect my real mistake was thinking we were facing a decade or more of this stuff. This has become the dominant media narrative too. As a responsible contrarian, it’s important to confront it.

Here’s why I think inflation is over.

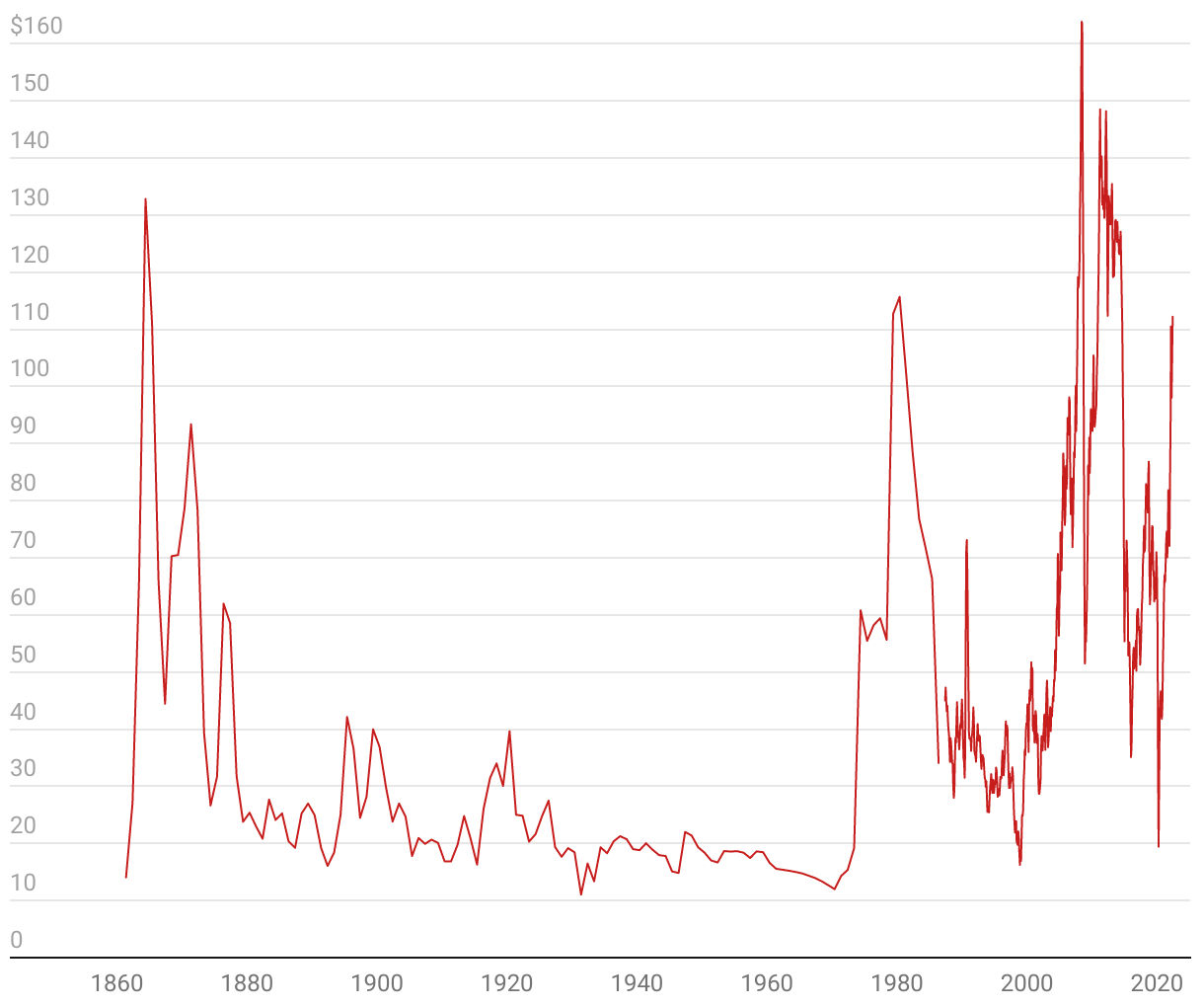

First, the idea of a secular inflationary era doesn’t fit the historical record. Inflationary conditions occur maybe two years in ten. Here is a long-term chart of oil prices:

Oil prices: the long view

Adjusted for US consumer price inflation. Annually to 1987, then monthly

(Please use a modern browser to see the interactive version of this visualization)

For 1861–1944: US Average. 1945-1983: Arabian Light posted at Ras Tanura. 1984-1987: Brent dated. June 1987 on: Europe Brent Spot Price FOB

Perhaps it will be. But not in the way the inflationists think. This may be the end of oil for good.

The recent oil price graph looks like a patient experiencing a heart attack. Two years ago it plummeted. This is forgotten now that we see Putin’s face hovering over crude oil but there were reasons for it. The forces lining up against oil are greater than ever before: electric cars are about to dominate the market now that old auto has finally got its act in order.

Fusion power may be 15 years away and solar power is cheap enough to be even more widely adopted if we allow Chinese panels in our markets.

Political will, already galvanised by the environmental agenda, has been tipped over the edge by Putin’s actions. Ending oil narrowly pips the need to punish China for its sins and protects US energy interests: Biden has just revoked tariffs on Chinese panels to the dismay of the three domestic US panel producers (not to mention Big Oil). Innovation and globalisation are being allowed to flourish again. Supply-side reform will be next. This is a good thing.

Many western inflationists believed that inflation was good for the man on the street because his wages would rise at last. This could not be further from the truth: inflation is a tax on the poor and a boon to old-industry fat cats.

If you want to see what this looks like, go to Sri Lanka today. Its residents are currently experiencing rates of inflation that put our cost-of-living crisis in perspective. It’s not just the poorest but entire swathes of the middle class that are up in arms. There are so many Sri Lankans out of work and unable to pay spiralling food, medicine, petrol or electricity prices that they have finally decided to kick out the kleptocratic interests who got them into this mess.

Inflation is a political choice and the reason it won’t endure is because it doesn’t work. So it’s worth asking again, as we look at the oil price chart: will it really be different this time? Are we really facing an inflationary era or, as before, its opposite?

This has huge significance when trying to predict Russia’s power over the coming decade. Russia’s economy is geared for inflation, not just because of oil but all the other commodities exports it relies on. It has gone into this war with a strong balance sheet and this has been boosted by the recent oil spike. But a deflationary, progressive period of economic history would be bad news for Russia. Russia may win in Ukraine but they will lose any wider war the same way they lost the Cold War: economically.

This has nothing to do with western sanctions on oil or other Russian goods. These can easily be avoided in a globalised world, as we are seeing at the moment. But the laws of progressive economics cannot be flouted. Russia is on the wrong side of the economic argument – a fact which could prove more important than the country being seen to be on the wrong side of progressive political or social norms.

Allowing increased globalisation and innovation (as America instinctively does) is a more certain, confident and innocuous way to cripple Russia’s capabilities than outright bellicosity. The end of the oil age spells the end of Russia’s ambitions. (It should be noted, however, that these dynamics do not hold true for China. Its increasingly innovative, scale-based economy is well geared to the deflationary trend, even if we may frown at some of its political or social norms. Our alignment with China remains the key geopolitical risk of the century. Russia was already small fry and has now ruled itself out, becoming a satellite of its larger ally.)

There are two sorts of progressives: one believes that progress happens, the other believes that it should. The case for optimism over inflation and Russia need only rest on the former; the case for fear and over-reaction rests on the latter.

A lot of contemporary discontent came from a turn against economic progress (for environmental and equality reasons). Recent economic and geopolitical events may remind us that traditional liberal values of free trade, peace and decentralised government do, in fact, win out over protectionism, war and centralised control. We should not give up on them now.

'經濟, 經營, 企業' 카테고리의 다른 글

| 韓国人がウォンを売り始めた 政府が「通貨危機は来ない」と言うも信用されず (0) | 2022.09.10 |

|---|---|

| What to expect from Samsung’s August Unpacked event (0) | 2022.08.06 |

| いま韓国の「財閥ランキング」に起きている「大きな異変」 (0) | 2022.06.16 |

| 半導体産業のジレンマ、半導体不足で半導体製造装置がつくれない (0) | 2022.06.06 |

| 금융시장 변동성 큰 한국, 대책은 (0) | 2022.05.24 |